Brian Davis’ company sues Bank of America

May 22, 2023

by Steve Thomas

The company allegedly owned by Brian Davis, Urban Echo Energy, filed suit in federal court in Maryland against Bank of America this past Friday. News reports previously indicated, and Davis himself discussed in multiple media spots, that Davis was interested in buying the Redskins Washington Football Team Washington Commanders Washington team. The Hog Sty obtained the pleadings. The lawsuit does not directly involve the team, Danny Snyder, or Pro Football, Inc., which is the entity controlled by Snyder that currently owns the team, or the projected new owners.

First, I need to say that I’m an attorney in real life (no, my actual name isn’t Steve Thomas), and I formerly represented Bank of America; therefore, I cannot get into details about the bank, its practices, or operations. I no longer represent the bank, and I don’t have any inside knowledge of this case, but in this situation, I am still obligated to stick to the basics.

The petition

Urban Echo Energy alleges two separate causes of action, conversion and replevin, in conjunction with Urban Echo’s alleged attempt to establish financing for a possible purchase of the team. The petition alleges that Urban Echo attempted to make two deposits, one in the amount of $5B and another in the amount of $100M, into a Bank of America Private Bank account controlled by Urban Echo, in order to “eliminate any questions” about Urban Echo’s financings to be used in an offer to buy the team. These deposits were funds allegedly drawn from one or more Citibank accounts supposed controlled by an entity called Urban Echo Capital Heights, LLC. According to the petition, Urban Echo Capital Heights, LLC, is a subsidiary of Urban Echo Energy.

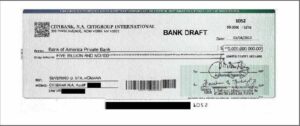

The petition claims that Urban Echo had two bank drafts – which are substantively similar to a certified check – drawn on March 8, 2023, which were presented to Bank of America for deposit. Photos of the two bank drafts were included as attachments to a verified statement signed by Davis included with the petition:

The substance of the dispute here is that Davis – through Urban Echo – alleges that Bank of America accepted the two bank drafts, but then neither deposited nor returned either one. The petition then goes on to say that Bank of America instead notified Urban Echo on March 15, 2023, that the bank was terminating Urban Echo’s accounts.

The petition then claims that Urban Echo made an offer to purchase the team for $7.1B anyway, but is silent on how such offer was conveyed. Allegedly, Bank of America never conveyed this offer to Snyder, who then went on to announce an agreement to sell the team to Josh Harris for $6.05B.

Urban Echo states in the petition that at that point, it made demand on Bank of America to either (a) deposit the bank drafts, or (b) return them. The bank allegedly did neither and instead is still in possession of the bank drafts.

The petition presents two counts, conversion and replevin. The legal concept of “conversion” is a taking of the property of another with the intent to deprive the person of that property; i.e., essentially, theft. In this situation, Urban Echo is alleging that because Bank of America accepted the bank drafts, but then neither deposited them nor returned them, the bank is then in unlawful possession of the two drafts.

The second count, replevin, is essentially a demand for the court to order the return property in which the defendant is in unlawful possession – in this case, the two bank drafts.

Urban Echo alleges damages in the amount of $5.1B, unspecified additional damages, unspecified compensatory damages, and unspecified punitive damages. If what Urban Echo alleges is accurate, then Citibank would have debited the Urban Echo Capital Heights, LLC, account(s) in the total amount of the two drafts, $5.1B. The basis behind the damage claim is presumably that, without those two drafts being deposited, Urban Echo is without an ability to access the funds.

One media outlet reported that Urban Echo had pled for damages in the amount of $500B. That is wrong.

My opinions

That’s the basis for the claim. What’s my opinion of this lawsuit? First, as I mentioned above, since I used to represent Bank of America, I’m prohibited from getting into the bank itself. However, generally, I have three big questions as a result of this petition: first, the operations and procedures of all major U.S. banks are heavily regulated, and none would refuse to deposit a bank draft while simultaneously also refusing to return the drafts, particularly drafts worth multiple billions of dollars, without just cause. What could such reason be? I’m hesitant to speculate because of my former representation of Bank of America, so use your imagination here, but off the top of my head, I would assume that it doubts the validity of the bank drafts, at a minimum.

Secondly, if these bank drafts are legit, couldn’t Urban Echo simply ask Citibank to cancel the bank drafts? We’re talking about $5.1B here, and these certified bank drafts aren’t regular checks – isn’t Citibank able to protect its major customers? If so, this would eliminate the monetary damages, making most of this lawsuit moot. The petition says nothing about Urban Echo making such an attempt; instead, they basically allege that Bank of America is holding $5.1B hostage. By itself, that makes little sense.

Third, why wouldn’t Urban Echo just initiate one or more wires from Citibank to Bank of America instead of doing a bank draft, which is a physical piece of paper? Being a veteran of many, many business transactions, including some in the nine figure range, I can’t recall any transaction of any magnitude done via a bank draft. As best I can remember, 100% of the business transactions I’ve worked on, with the exception of one small foreclosure sale of real property, have been conducted via wires. It’s the business standard and I find it exceedingly odd that Urban Echo would conduct business this way, especially for such an enormous amount.

I don’t know plaintiff’s counsel at all, so I can’t speculate about his skills or abilities, but it’s worth pointing out that plaintiff’s counsel is not a major law firm, which one would normally expect for a 10 figure lawsuit. Make of that what you will.

Regardless, something seems off about this claim; I’m not willing to speculate more. We’ll all find out in time.

What’s next?

The petition still needs to be served on Bank of America. After that occurs, the bank will have to either file an answer or at least file some sort of motion regarding the petition within 21 days of service. Bank of America could file any number of pre-answer legal motions if they so desire, as well as a variety of other legal challenges. At some point, if the lawsuit survives such challenges, discovery will take place. Regardless, at some point, we’ll learn the truth of this situation, because it is entirely unclear based solely on this petition.

Feel free to put any questions you may have in the comment section, and I’ll try and answer them.

Pingback: More on Brian Davis and Urban Echo - Commander Fans

Pingback: More on Brian Davis and Urban Echo – The Hog Sty

Pingback: Brian Davis’ Company Sues Bank Of America - SportyWorty News

Pingback: Brian Davis’ company sues Bank of America - Commander Fans